Home loans for medical professionals give those working in the industry special loan deals and benefits that are not available to the general public, such as exclusive interest rate discounts and no Lender’s Mortgage Insurance (LMI). If you are a professional in the medical field living in Northern NSW or the Gold Coast, Davies Home Loans can help simplify the lending process. We compare the loans, negotiate on your behalf, complete all the paperwork and work around your schedule to simplify the process as we know your time is precious.

We specialise in high income loans for medical professionals and as a specialist broker we have access to more than double the amount of lenders than regular brokers. We understand the ins and outs of health professional loans and can help you to navigate the process from start to finish and beyond.

16+ Years Of Experience

Why Trust Us As Your Medical Professional Mortgage Broker?

Davies Home Loans understands that working in the medical field is a high pressure job with long hours that can both exhausting and demanding. That’s why we’re dedicated to simplifying the home loan process for medical professionals and ensuring that you receive the right deal for your needs and income so you can focus on more important things.

Here’s why you can trust us with your home loan:

We specialise in high income loans, including Medico home loans

We’ve been doing this for over 15 years

We have access to 40+ lenders in Australia

We understand the unique requirements of medical home loans and can navigate your application to a successful settlement

We work flexible hours and can work outside of hours

We can come to you

TRUSTED BY GOLD COAST MEDICAL PROFESSIONALS

What Home Loan Benefits Are Available To Medical Professionals?

Your high income as a medical specialist makes you a low risk candidate for a home loan. That’s why lenders are more willing to offer exceptional mortgage products and deals that aren’t accessible to the public. Benefits can include:

No LMI On Mortgages

Discounted or waived LMI fees up to 95% LVR

Higher Borrowing Capacity

A higher Loan to Value Ratio (LVR) meaning that you can borrow more, sometimes up to 100% in some cases, and pay less deposit

Access to lower rates

As a medical professional, you gain access to significant discounts off fixed and standard variable rates

Let Us Take Care Of You

Home Loans For Nurses

Nurses and midwives are now eligible for their own range of exclusive discounts announced in October 2022 by select lenders. This can include no LMI fees on loans with a 10% deposit or up to 90% loan to valuation ratio (LVR) as well as lower interest rates for loans over $250,000.

Davies Home Loans is proud to work with nurses on the Gold Coast and Northern New South Wales to help them secure a home loan and take care of their needs. We know how to minimise common mistakes and get you the best deal by considering everything from overtime income to meal allowances and fringe benefits.

Home Loans For Healthcare Workers – Who Is Eligible?

The Gold Coast is fortunate to have an extensive range of medical facilities in the region, from hospitals to specialist centres. Kingscliff Hospital adds to the growing health options in this area. We’re able to support the vast majority of professionals in the local medical field.

Here are just some of the approved medical professions eligible for exclusive professional loan packages offered by lenders. This is far from a complete list. Please contact us to find out if you are eligible for a medical professional loan:

Paediatrician

Dentists

Anaesthesiologist

Anaesthetist

Obstetrician

Neurologist

Pharmacist

Gastroenterologist

Gynaecologist

Immunologist and much more

We work with many medical specialists in the Gold Coast and Northern NSW region from esteemed facilities such as:

Above are Lenders and support businesses available to us, specific accreditations are provided as part of our loan process

Medical Professional Home Loans

Whether you want to buy your first home, refinance or enter the world of property investment, a medical specialist home loan can help you to do it. As the criteria for home loans for medical professionals becomes more flexible, a wider range of specialists are now being considered for approval. Let us help you take your first steps into owning your dream home or buying your next investment property.

Give Davies Home Loans a call today to discover what we can do for you and your future.

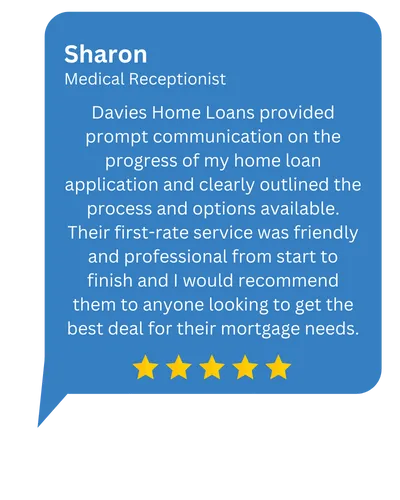

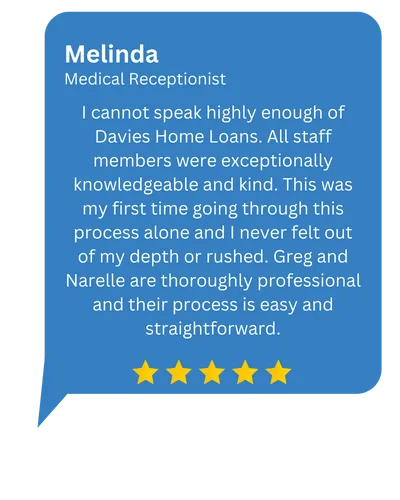

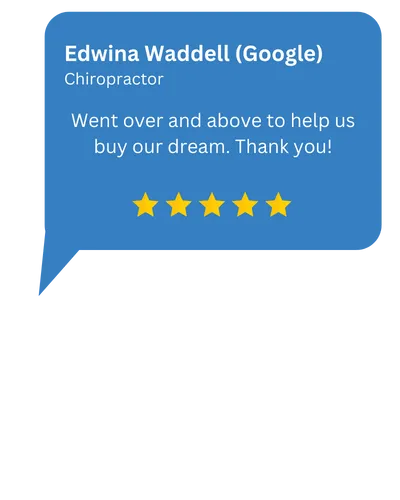

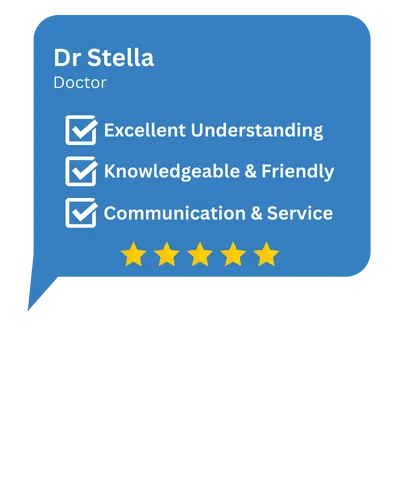

What Our Clients Say

Financial Calculators

Doctors can often get access to higher borrowing capacities due to having a higher income. Our finance calculators can help you to determine how much you might be able to borrow.

Borrowing Power Calculator

Determine how much you could borrow based on your income, expenses and other debt.

Loan Comparison Calculator

Enter both your current loan and the new loan amounts, interest rates & fees to compare which loan will suit you.

Loan Repayment Calculator

Calculate your monthly, fortnightly or weekly payments required to pay your loan.