If you work as a lawyer or barrister, a home loan for lawyers can be the answer to obtaining your dream home and lifestyle. Due to their high income and job stability, legal professionals are privy to special home loan deals that are not accessible to the public which can include discounted interest rates and other benefits. Davies Home Loans are specialists in high income loans for lawyers with extensive experience in negotiating the right home loan for each individual. With access to 40+ lenders and the latest mortgage products, we’ll find a home loan that meets your unique needs before negotiating and settling the deal on your behalf. If anything changes in the future, we’ve got your back.

Who Is Eligible For Lawyers Loans?

As a professional in the legal field, you may be eligible for a high income loan made specifically for specialists in law. The reason behind this is that these job positions are considered very low risk with long-term career prospects which means banks are more willing to loan money as borrowers will rarely default on making repayments.

16+ Years Of Experience

There are some criteria that you will need to meet for approval:

You must be registered to practice as a legal professional, such as a lawyer, barrister, solicitor or partner even if not currently actually practicing

In most cases, you will need to be earning over $150K

You will typically need to be registered with your state

Your credit history, assets and employment need to be within the standard bank policy

Generally, the maximum loan cannot exceed $2.7 million for a single property

What Is Included In Home Loans For Lawyers?

A home loan for lawyers gives you exclusive access to benefits not available to the general public. These include:

- No LMI if you borrow up to 95% of the property price

- Discounted and negotiated interest rates

- Flexible credit when financing your practice

- Higher exposure limits if you purchase more than one property

- Purchases and refinances are acceptable

- Your home loan can be placed in the name of a company or a trust

No LMI On Mortgages

You can avoid Lenders Mortgage Insurance

Higher Borrowing Capacity

You can borrow up to 95% of the value of your new property

Access To Discounts

As a legal professional, you gain access to exclusive discounted interest rates that are not available to the general public.

Tweed Heads Mortgage Brokers

What Are The Benefits Of Working With A Specialist Mortgage Broker?

Many banks and general mortgage brokers are not familiar with the ins and outs of high income loans and the options available to lawyers looking to secure their own home or investment property. As a specialist in loans for a lawyer, our team regularly deal with these types of loans and have access to a full range of lenders and mortgage products available to legal professionals.

We’ll source and compare over 40 lenders in our panel to find the right product for you, then negotiate and settle on your behalf. We make sure we stay up-to-date on all of the latest changes in lending policies and conditions from our vast range of lenders so that we can always offer choice, advice and source a mortgage product that meets all of your needs, now and in the future.

Above are Lenders and support businesses available to us, specific accreditations are provided as part of our loan process

Contact Davies Home Loans today to compare your options when it comes to loans for lawyers.

If you’re unsure whether you qualify for a home loan for lawyers, give Davies Home Loans a call. We may also be able to include other income sources and mitigate circumstances to find the right home loan for you.

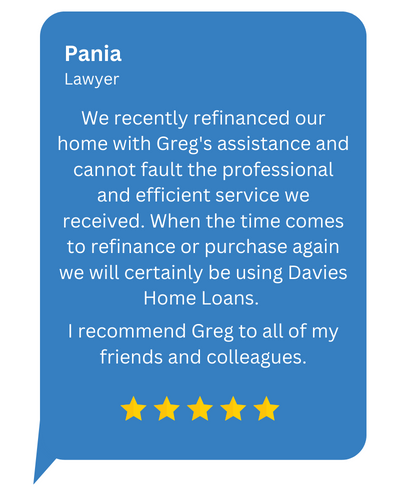

What Our Clients Say

Financial Calculators

Doctors can often get access to higher borrowing capacities due to having a higher income. Our finance calculators can help you to determine how much you might be able to borrow.

Borrowing Power Calculator

Determine how much you could borrow based on your income, expenses and other debt.

Loan Comparison Calculator

Enter both your current loan and the new loan amounts, interest rates & fees to compare which loan will suit you.

Loan Repayment Calculator

Calculate your monthly, fortnightly or weekly payments required to pay your loan.