At Davies Home Loans we specialise in home loans for Doctors, we can help you to find your ideal mortgage product that meets your individual needs and high-income status. If you’re a professional in the medical field, it’s likely your time is precious. We understand the need to fit in around your work commitments and our role take care of every step in the process for you so that you can focus on the important things. Doctors are entitled to a number of benefits that are not available to the general public. As specialists in loans for Doctors we have access to a wider lending panel than most brokers and we’ll tailor your home loan to suit you with competitive interest rates, flexible repayment terms and end-to-end service.

Why Do Doctors Get Special Interest Rates?

Medical professionals are typically earning more than the general public. As such, they have exceptional standing with banks and lenders because they offer a high earning capacity with a significantly lower risk of being unable to fulfil loan repayments on time. Lenders are keen to loan money to doctors which means that there are plenty of exclusive offers to choose from that members of the general public do not have access to.

16+ Years Of Experience

Who Is Eligible For A Doctors Mortgage Package?

Doctors home loans are available to medical professionals that earn a higher salary than the average Australian. We’ve helped secure loans for Doctors across the road from us at the Tweed Health for Everyone Superclinic and medical professionals from hospitals and clinics throughout the Gold Coast & Northern NSW regions. Specialist medico home loans are available to those who work in the medical field.

This can include:

Doctor

General Practioner

Anaesthetist

Dermatologist

Cardiologist

Cosmetic surgeon

Neurologist

Psychiatrist

Oncologist & much more

What Benefits Does A Mortgage For Doctors Include?

As a doctor or specialist in the medical field, you have access to special home loan deals that the average borrower does not. These include:

No LMI On Mortgages

You can avoid Lender Mortgage Insurance

Higher Borrowing Capacity

You can borrow up to 95% of the value of your new property

Access To Discounts

As a medical professional, you gain access to exclusive discounted interest rates that are not available to the general public. This can be up to 2% of the standard rate

Tweed Heads Mortgage Brokers

We’re Specialists In Home Loans For Doctors

You wouldn’t go to a GP when you have a problem that only a specialist can handle. Why go to a general mortgage broker looking for a doctors home loan? At Davies Home Loans, we are specialists who excel in high income loans for medical professionals and can get you the right mortgage for your unique needs and income.

We understand that your job is often demanding and your time is precious. That’s why we take the time to understand your circumstances so that we can find you a mortgage product that supports your situation, now and in the future. We have access to 40+ lenders in Australia offering a wide variety of home loans for doctors with low interest rates and generous terms. We’ll work with you to compare each loan, help you to choose one that suits your needs and handle the entire process from start to finish so that you don’t need to worry about a thing.

Above are Lenders and support businesses available to us, specific accreditations are provided as part of our loan process

We Can Also Assist With Commercial Lending For Doctors.

If you are considering starting a new business, expanding or purchasing a new practice then it’s likely you may have already heard of a goodwill loan.

We can assist will all your lending needs including secure goodwill funding with up to 100% LVR from some lenders.

Take the first step towards owning your dream home today. Give Davies Home Loans a call to discover how we can help you buy your first home, invest in property or refinance. You can also use our online calculator to determine how much you can borrow based on your income, expenses and existing debt. At the end of the day, our team will provide tailored solutions for your personal and business lending needs so you can have complete peace of mind.

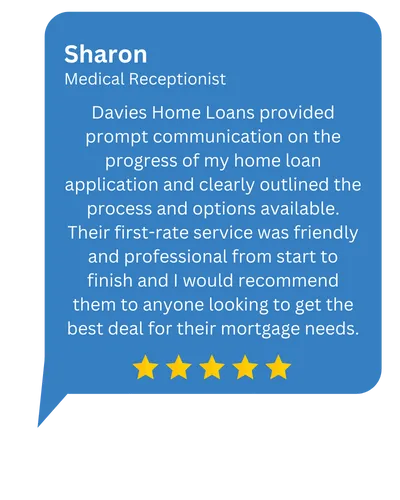

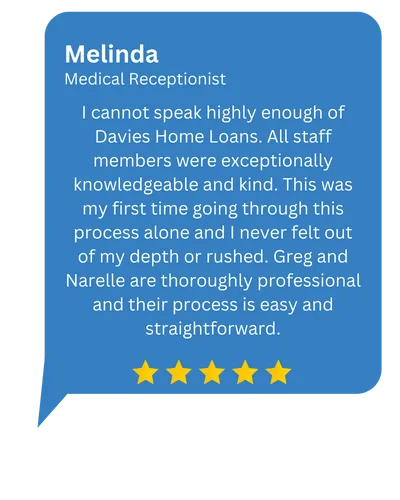

What Our Clients Say

Financial Calculators

Doctors can often get access to higher borrowing capacities due to having a higher income. Our finance calculators can help you to determine how much you might be able to borrow.

Borrowing Power Calculator

Determine how much you could borrow based on your income, expenses and other debt.

Loan Comparison Calculator

Enter both your current loan and the new loan amounts, interest rates & fees to compare which loan will suit you.

Loan Repayment Calculator

Calculate your monthly, fortnightly or weekly payments required to pay your loan.